Table of Content

- Veterans with disabilities can apply for VA loans with grants.

- VA Loan Calculator – Estimate Monthly Mortgage Payments

- State Property Tax Exemptions

- VA Special Housing Adaptation Grant (SHA)

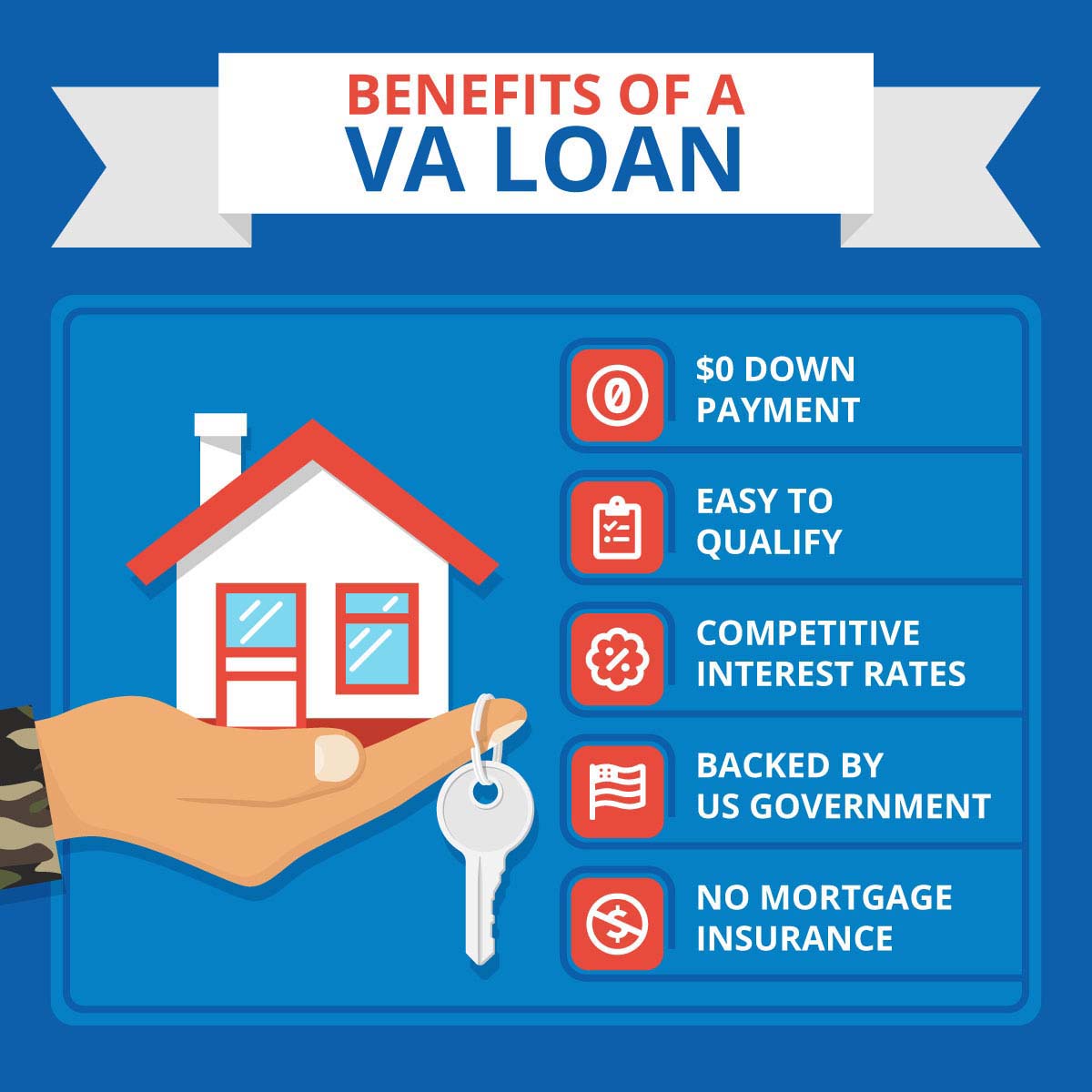

- Veterans with disabilities get the benefits of a VA loan along with grants, no funding fees, and more

- How much will I pay?

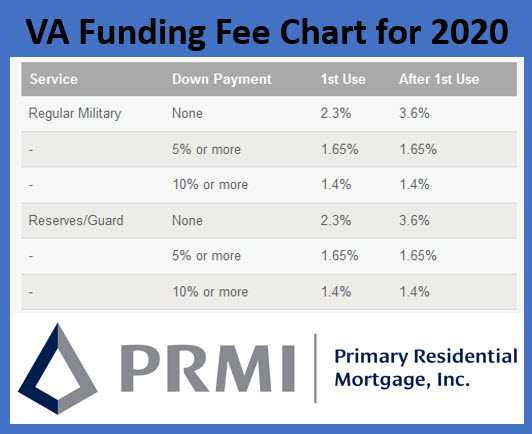

The Department of Veterans Affairs affirmatively administers the VA Home Loan Program by assuring that all Veterans are given an equal opportunity to buy homes with VA assistance. Borrowers who make a down payment may be entitled to a reduction in their VA Loan funding fees. The funding fee depends on the type of transaction , amount of your down payment , the number of times you have used the VA Loan, and your service category . The VA Loan program is self-sufficient and does not rely on additional government funding or funds from other VA benefits programs. It sounds like using a conventional mortgage would have worked out well.

Veterans with disabilities won't have to pay the VA funding fee, and can use disability income to qualify for the mortgage. If you paid the funding fee, you can write it off on your taxes as long as it’s within the same year you paid it. When the fee is refunded, however, you’ll be required to declare it as income on your tax return. Talking with your mortgage lender or servicer is usually your best first step if you have questions about getting a refund of the VA funding fee. Questions on funding fee exemption can be especially tricky for buyers transitioning from the service back into civilian life. Lenders are not required to reduce the loan balance by funding fee amount financed into the loan.

Veterans with disabilities can apply for VA loans with grants.

A copy of your original VA notification of disability rating and documentation of your service retirement income . The VA funding fee is lowest for first-time VA loan borrowers who choose to make a down payment of at least 10% on their home loan. This fee covers losses if a VA loan defaults, as the Department of Veterans Affairs guarantees these loans. To qualify for a VA loan, income must meet three standards – it must be stable, reliable, and expected to continue. The critical factor in using disability pension toward a VA loan is that your payments are likely to continue. With a VA loan, you may also be suitable for a Mortgage Credit Certificate .

It would have required less paperwork and probably would have closed a few days more quickly. We have excellent credit scores so we could have easily qualified for a conventional mortgage or qualified for a VA Loan. Certificate of Eligibility notes indicating the borrower is an unmarried surviving spouse. Remember, the VA has the last word on who is exempt, and some issues may be dealt with on a case-by-case basis.

VA Loan Calculator – Estimate Monthly Mortgage Payments

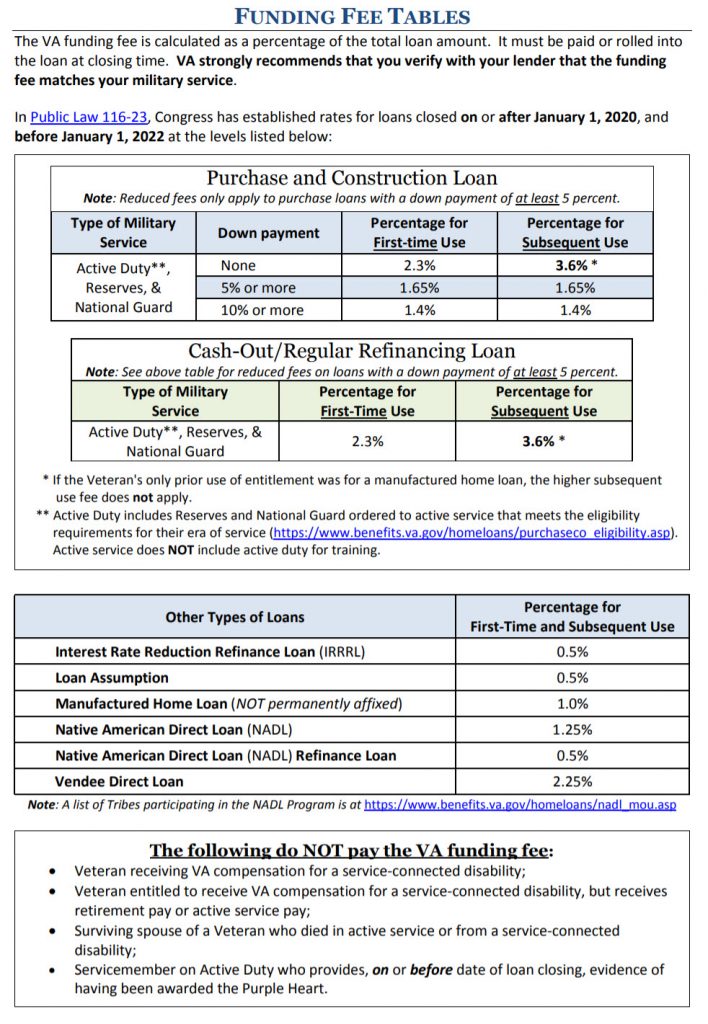

You can accomplish this by contacting your regional VA center with your lender’s information and they will fax the appropriate documents to your lender. This VA Interest Rate Reduction Loan case study explains how you can use this program more than once to shave percentage points off your loan. Affixed)1.0%Loan Assumptions.50%Of note is the funding fee for a VA Interest Rate Reduction Loan , or Streamline Refinance. The borrower applies for the VA loan and submits a VA Certificate Of Eligibility .

Veterans must include a physician’s diagnosis and approval of home modifications with their HISA grant applications. Veterans with at least a 50% VA rating for a service-connected disability can receive a lifetime benefit of $6,800. Those with non-service connected conditions can receive a lifetime benefit of $2,000.

State Property Tax Exemptions

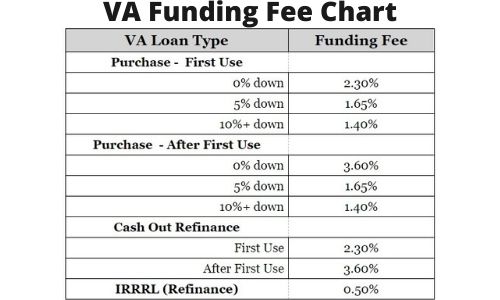

The Cash-Out refinance allows qualified Veterans to refinance and extract cash from equity, and it's open to eligible Veterans with VA and non-VA loans. As you'll see in the VA funding fee table for 2022 below, Veterans purchasing with a VA loan for the first time receive a lower fee than subsequent users. Though not required, first-time and subsequent purchasers can decrease the funding fee with a minimum 5% down payment.

The funding fee can be paid upfront along with your closing costs but most home buyers roll it into their loan amount so they don’t have to pay extra at closing. In 2019, changes to the VA loan program brought modifications including a new approach to dealing with issues related to VA borrowers who may be exempt from having to pay the funding fee. While the VA requires most borrowers to pay the VA funding fee, not every borrow must. A handful of exemptions exist, including borrowers who receive compensation for service-connected disabilities. But borrowers and homeowners with a disability rating of at least 10 percent are exempt from paying the VA Funding Fee. Depending on the loan amount, having this fee waived can save a solid chunk of change.

VA Special Housing Adaptation Grant (SHA)

Disabled veterans are given special considerations when they apply for a VA loan? Today we will discuss additional benefits and VA loan tips available to you based on your disability status that can help you save more. VA funding fees for home buying range from 1.4% to 3.6% of the loan amount, while fees for a VA refinance range from 0.5% to 3.6 percent (for a repeat VA borrower using a cash-out refinance). As of January 1, 2020, the VA funding fee rate is 2.30% for first-time VA loan borrowers with no down payment.

The first part of Chapter 8 reminds us that the VA loan funding fee is meant to offset the use of tax dollars, but also that the funding fee is subject to change or revision by Congress. Once the VA receives the paperwork and approves the exemption, the lender is then notified of your exempt status. If you're utilizing the VA Streamline refinance , the funding fee is .5%. The VA cash-out refinance follows purchase requirements at 2.3% or 3.6%, depending on prior use. There is no one-size-fits-all answer or flat rate when it comes to VA funding fee amounts.

The VA funding fee is meant to offset the taxpayer cost of the loan program, but the exemption makes an exception for borrowers disabled due to their military service. The VA loan offers active troops and veterans an incredible mortgage option. But, to offset the costs of the program, the government charges many borrowers a funding fee. And, if you’ve been incorrectly charged, a path exists to seek a refund. As such, we’ll use this article to explain how to get a VA loan funding fee refund.

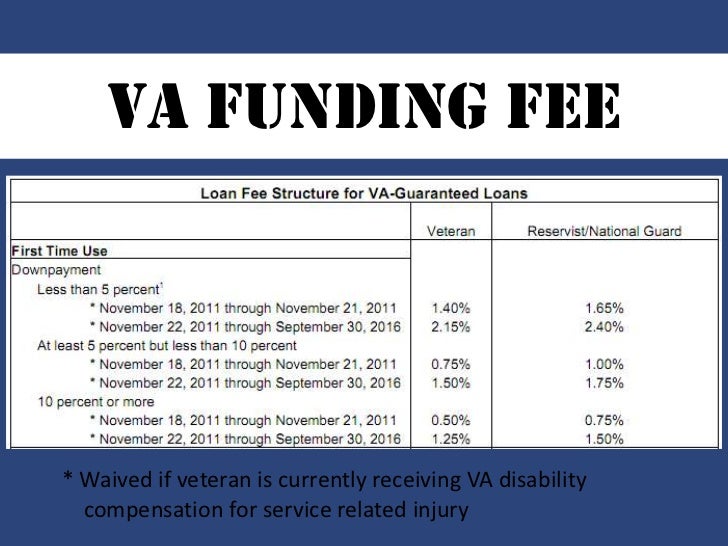

Read above VA loan tips in order to maximize your VA home loan benefits and save your time. Prior to 2020, guidelines for the VA funding fee were in effect from 2011 to 2019. They will be reviewed again, but the specific date has yet to be established.

No comments:

Post a Comment